Unlocking Potential: The Financial Landscape for Self-Employed Women in India

Survey Reveals Funding Gaps and Digital Trends Among Women Entrepreneurs

A recent survey conducted by DBS Bank India and CRISIL highlights significant challenges faced by self-employed women in urban India regarding access to financial resources. The study found that a staggering 65% of self-employed women in major Indian metros have not secured a business loan, with 39% depending on personal savings to fund their ventures.

Understanding the Funding Preferences

Among those who have taken loans, bank loans remain the preferred choice, selected by 21% of respondents. The survey underscores a prevalent risk-averse mentality, as 28% of women entrepreneurs utilize personal property as collateral, while 25% opt for gold. This conservative approach to investment is further reflected in the finding that 64% of women using gold as collateral primarily invest in safer options like savings accounts.

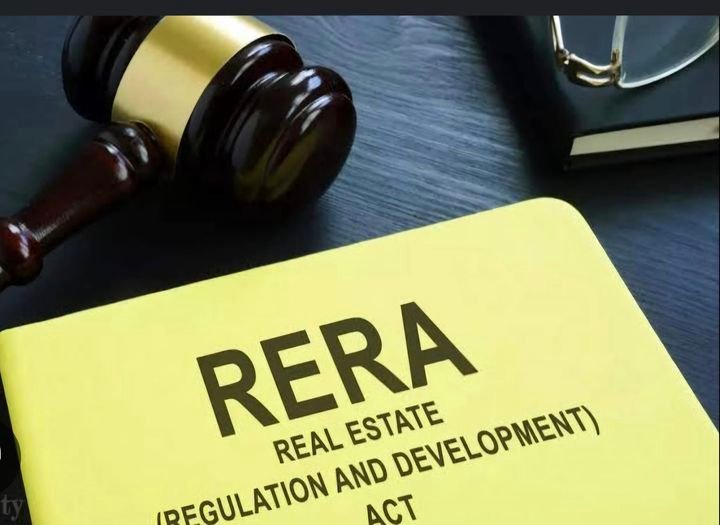

Awareness and Utilization of Government Schemes

The survey also uncovers a troubling gap in awareness regarding government assistance programs. Approximately 24% of respondents are unaware of available schemes, and 34% have not utilized any government support for their businesses. To address this, initiatives are underway to enhance financial literacy among women entrepreneurs, particularly in marginalized communities.

Digital Payment Preferences Shaping the Future

In the digital realm, the Unified Payments Interface (UPI) has emerged as a game changer, facilitating easier financial transactions. The survey reveals that 73% of self-employed women prefer digital payments from customers, with 87% utilizing digital methods to manage business expenses. Notably, UPI is the most popular mode for transactions, being used for 35% of incoming and 26% of outgoing payments.

Support Beyond Finance: Mentorship and Community Engagement

While financial assistance is crucial, the survey indicates a desire for additional support. About 26% of women entrepreneurs seek mentorship, 18% require guidance navigating government schemes, and 15% want help with digitizing their financial processes. This highlights a broader need for networking and community-building initiatives.

Commitment to Sustainability and Inclusivity

The findings also shed light on a growing commitment to sustainability among self-employed women. An impressive 52% have implemented sustainability policies within their businesses. Key initiatives include energy conservation and waste reduction, with many prioritizing female representation on their boards.

A Call for Enhanced Support Systems

The insights from the survey call for a concerted effort to empower self-employed women through better access to financial resources, enhanced awareness of government schemes, and supportive networks. As India moves toward a more inclusive economy, addressing these gaps will be vital in unlocking the full potential of women entrepreneurs.

English

English