Revolutionizing India’s Office Space Market: GCCs and Sectoral Shifts Drive Demand

Revolutionizing India’s Office Space Market: GCCs and Sectoral Shifts Drive Demand

GCCs Set to Shape 40% of Grade A Office Space Demand in India

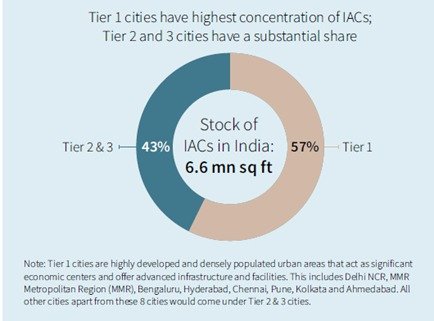

Bengaluru, 12 September 2024: The landscape of office space demand in India is undergoing a significant transformation. According to the latest Colliers report presented at the RICS CRE FM conference in Bengaluru, Global Capability Centers (GCCs) are poised to contribute nearly 40% of the demand for Grade A office space in the upcoming years. This shift reflects a broader diversification of occupiers beyond the traditional tech sector, encompassing engineering & manufacturing, BFSI (Banking, Financial Services, and Insurance), healthcare, consulting, and flexible workspaces.

Sectoral Dynamics: Engineering & Manufacturing and BFSI Lead Demand

Engineering & Manufacturing Surge: Over the next three years (2025-27), engineering & manufacturing and BFSI occupiers are expected to lease approximately 11-12 million sq ft of office space annually. This represents a significant increase from the 8-9 million sq ft leased annually in the past three years. Together, these sectors are projected to account for around 40% of the total office space demand.

BFSI Trends: BFSI occupiers are anticipated to favor premium developments, while engineering & manufacturing firms are expected to remain cost-conscious in their real estate expansion.

Technology and Flex Spaces: Technology firms are expected to stabilize their space demand at around 15 million sq ft, as hybrid and distributed work models take hold. Flex space occupiers are projected to capture 15-20% of total office leasing in the next few years, expanding into newer regions.

Leasing Trends Across Key Sectors

Technology Sector:

Before 2022: 41% share in gross leasing

2022-24: 27%

2025-27 Forecast: 24%

Annual Leasing: 15 million sq ft

Engineering & Manufacturing:

Before 2022: 10% share

2022-24: 16%

2025-27 Forecast: 20%

Annual Leasing: 12 million sq ft

BFSI:

Before 2022: 13% share

2022-24: 17%

2025-27 Forecast: 18%

Annual Leasing: 11.5 million sq ft

Flex Spaces:

Before 2022: 13% share

2022-24: 15%

2025-27 Forecast: 17%

Annual Leasing: 10.5 million sq ft

City-Specific Trends: Bengaluru Leads, Hyderabad, Chennai, and Pune Gain Ground

Bengaluru’s Dominance: Bengaluru remains a major hub for Grade A office demand across various sectors. However, cities like Hyderabad, Chennai, and Pune are emerging as key players, showing significant growth in demand from flex spaces, BFSI, and engineering & manufacturing firms.

Micro Market Highlights: Notable micro markets such as Hyderabad’s SBD, Chennai’s OMR Zone 1, and Pune’s Baner-Balewadi are witnessing increased traction, indicating evolving locational preferences of occupiers.

Transaction Trends: Rationalizing Sizes and Growing Volumes

Post-Pandemic Shifts: The average deal size has decreased by 11% compared to 2019 levels, reflecting the adoption of distributed work models. Despite smaller average deal sizes, the number of deals has surged by 44%, indicating a rise in mid-sized transactions.

Expanding Office Footprints: With corporates increasingly adopting decentralized work strategies, there is a noticeable shift towards expanding offices across multiple locations with smaller footprints.

Sectoral Preferences: Premium and Green Certifications in Focus

BFSI and Consulting: These sectors continue to favor premium Grade A buildings in Central Business Districts (CBDs), willing to pay a premium for top-tier amenities.

ESG Considerations: Approximately 75% of space take-up in 2024 is anticipated to be in green-certified buildings. Sectors such as Engineering & Manufacturing, BFSI, and Technology are leading this trend towards sustainable real estate.

Looking Ahead: Sustainable Growth and Emerging Markets

Future Outlook: The Indian office space market is set to experience heightened growth driven by evolving demand patterns and a shift towards sustainable development. With nearly 80% of the upcoming supply expected to be green certified, developers and investors have significant opportunities to lead in sustainability and meet the growing preferences of occupiers.

English

English