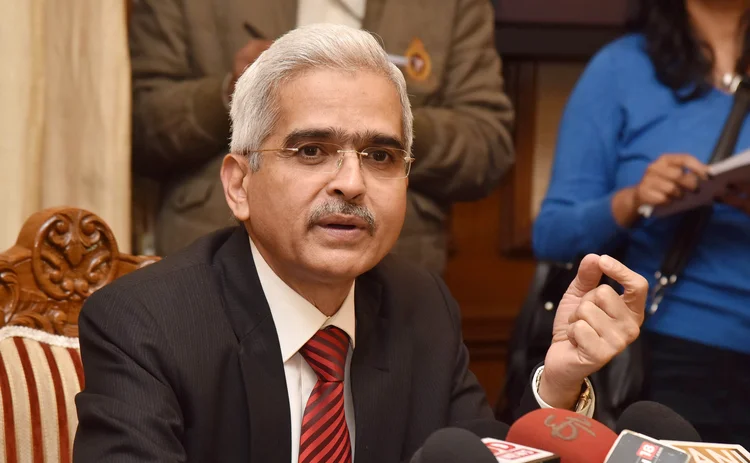

RBI’s Interest Rate Cut Debate Heats Up Amid Rising Inflation Concerns

With calls from Union Minister Piyush Goyal and Finance Minister Nirmala Sitharaman for an interest rate cut, questions are now swirling about whether the Reserve Bank of India (RBI) will heed these appeals in its upcoming monetary policy committee meeting next month. However, one critical issue has sparked debate—whether retail inflation should be the basis for deciding a reduction in interest rates.

Economic Survey Raises Key Concerns Over Retail Inflation’s Impact on Interest Rates

The Economic Survey for FY 2023-24 highlighted the complexities surrounding the determination of interest rates based on retail inflation. The survey pointed out that retail inflation encompasses the price increases of food items and energy, while interest rates should ideally be set based on core inflation—the rate excluding food and energy. This stance aligns with global practices in major economies like the US, Europe, and Japan, where interest rates are decided after excluding volatile food and energy prices.

Experts Express Reservations on Using Retail Inflation for Monetary Decisions

Notably, prominent economist and former Chief Statistician of India, TCA Anant, disagrees with setting interest rates based solely on retail inflation. Anant argues that food prices are often influenced by supply shortages, and while demand can increase for other goods, any inflationary pressure can be managed through monetary policy. This suggests that retail inflation may not always be a reliable indicator for adjusting interest rates.

Seasonal Price Hikes in Essential Goods Add to Inflationary Pressures

Finance Minister Nirmala Sitharaman has also pointed out that much of the current inflation surge is driven by the rising prices of essential items like potatoes, onions, and tomatoes, which tend to increase due to seasonal supply-demand mismatches. While these price hikes contribute to higher inflation, Sitharaman noted that inflation in other sectors remains under control. In October, inflation surged to 6.2%, the highest in 14 months, a point that raises concerns over its prolonged impact on the economy.

RBI’s Reluctance to Cut Interest Rates Amid High Inflation

The RBI has been cautious about cutting interest rates when inflation remains high, as lower rates could stimulate greater demand in the economy, further driving up prices. This could ultimately undermine the efforts to control inflation and stabilize the economy.

Disagreement on Using Inflation Rates for Monetary Policy Decisions

Economist Ashwini Mahajan, the convener of Swadeshi Jagran Manch, believes it would be a grave mistake to base interest rate decisions solely on seasonal price fluctuations, like the increase in vegetable prices. In a developing economy like India’s, Mahajan stresses that the primary goals of the monetary policy committee should be economic growth, job creation, and uplifting the poor. He also pointed out that there is a significant difference between wholesale and retail inflation, making retail inflation an inadequate basis for deciding interest rates.

RBI’s Inflation Targeting Framework: A Double-Edged Sword

The RBI has set an inflation target range of 2% to 6%, with 4% as the ideal rate. If inflation falls below 4%, the RBI considers it suitable for a rate cut. However, Mahajan argues that focusing solely on inflation ignores broader economic objectives. The policy framework, which was established with the formation of the Monetary Policy Committee eight years ago, remains under scrutiny.

A Complex Economic Landscape: Diverse Views on Rate Cut Decision

On the other hand, Professor Pinaki Chakraborty from the National Institute of Public Finance and Policy believes that both the government and the RBI are correct in their approach. Given India’s vast and complex economy, Chakraborty emphasizes that inflation remains the key instrument for setting interest rates, but the challenges involved in its application cannot be understated.

As the debate intensifies, the question remains: will the RBI prioritize inflation control, or will it consider the broader economic implications when deciding on interest rate cuts? Only time will tell as the economy navigates these turbulent times.

English

English