India Rises to Third Place Globally as an Attractive Real Estate Destination for Foreign Investors

Surging Foreign Interest Places India Third Worldwide for Land and Development Investments

India is rapidly ascending the ranks as a prime destination for foreign investors, securing the third position globally for land and development investments in 2024, as highlighted in the latest report by Colliers. This shift is largely driven by substantial inflows into the industrial and warehousing sectors, which now attract around 70% of all foreign real estate investments in the country.

Industrial and Warehousing Investments Soar

The growing demand from logistics companies, particularly those supporting e-commerce, alongside manufacturers expanding in strategic industrial zones, has propelled this trend. According to industry experts, investments in India’s industrial assets have surged to five times higher in the first half of 2024 compared to the same period last year. This reflects increasing investor confidence in the sector, driven by the rising demand for Grade A assets and evolving supply-chain dynamics.

Asia Pacific Leads the Charge in Global Capital

The report also reveals that the Asia Pacific region is home to four of the top ten global sources of cross-border capital. China tops the list with a staggering $36.48 billion, followed by Singapore at $1.93 billion, and India at $1.49 billion. These figures underscore a significant regional focus on investments, with India capturing 3.1% of the total global capital.

Institutional Investment Trends in India

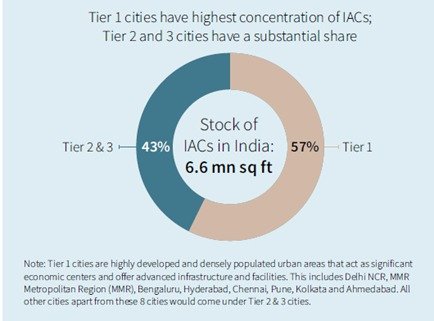

Institutional investors are showing robust interest in Indian real estate, with inflows reaching $3.5 billion in the first half of 2024. Notably, 70% of these investments are concentrated on ready assets, indicating a strong preference for immediate returns. The potential for future developmental opportunities is also on the horizon, fueled by rapid infrastructure development.

Positive Outlook for Future Investments

Experts suggest that the combination of healthy domestic demand, strong GDP growth, and potential monetary policy easing will sustain investment momentum in the Indian real estate sector. The Asia Pacific region continues to be a focal point for economic activity, with specialized sectors like data centers and cold storage gaining traction among global investors.

As India solidifies its position as a global investment hub, the interplay of industrial demand and foreign capital influx is likely to shape the future landscape of real estate in the country, making it an attractive option for international investors looking to capitalize on emerging opportunities.

English

English