DLF’s Impressive Surge in Sales and Profits Marks Resilient Growth Amidst Housing Boom and Strategic Expansions

Triple Growth in Sales Bookings in First Quarter

DLF, India’s largest real estate developer, has made headlines with an impressive over three-fold jump in its sales bookings, hitting approximately ₹6,400 crore in the first quarter of this fiscal, up from ₹2,040 crore in the same period last year. This growth trend continued into the first half of the fiscal year, with DLF’s sales bookings surging by 66% to reach ₹7,094 crore, compared to ₹4,268 crore during the first half of the previous fiscal year. The increased demand for housing has fueled this momentum, signaling a robust market recovery.

Second Quarter Dip and Approval Delays

However, the second quarter presented challenges, with DLF’s sales bookings falling by 69% to ₹692 crore from ₹2,228 crore in the year-ago period. This decline primarily stemmed from a delay in securing necessary approvals for launching new projects. DLF stated in an investor presentation that the reduction was due to these administrative hold-ups, but has now received approval for its much-anticipated super-luxury project, ‘The Dahlias,’ located in DLF 5, Gurugram.

Strong Guidance and Positive Outlook for Fiscal Year

Despite these fluctuations, DLF remains optimistic. The company has reaffirmed its goal of achieving ₹17,000 crore in sales bookings for the full fiscal year, driven by a strong demand outlook in the residential sector. The stability of DLF’s housing segment continues to enhance its growth potential, positioning the company as a leading figure in the real estate market. DLF’s consistent performance reflects the ongoing strength of the residential market and the company’s focus on catering to both high-end and mid-segment housing needs.

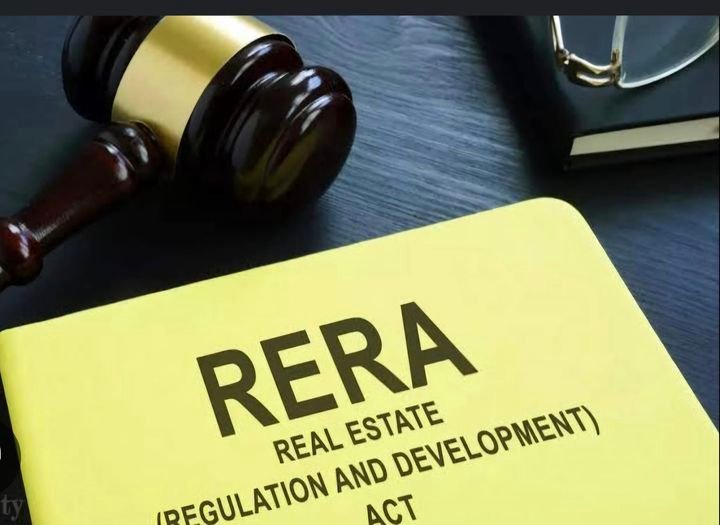

Net Profit and Revenue Surge

Reflecting Financial Robustness Financial performance has also been robust. DLF’s net profit more than doubled in the second quarter, reaching ₹1,381.08 crore, up from ₹622.78 crore a year earlier, with a total income increase of 48%, amounting to ₹2,180.83 crore. Over the first six months of this fiscal year, net profit has seen a significant rise to ₹2,026.69 crore from ₹1,149.78 crore, with total income climbing to ₹3,910.65 crore from ₹2,998.13 crore in the previous year’s corresponding period.

Expansion Portfolio and Development Potential

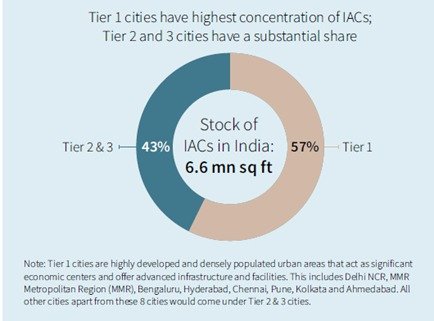

DLF has an impressive legacy, having developed over 178 real estate projects covering more than 349 million square feet, and it currently holds a potential development capacity of 220 million square feet across residential and commercial sectors. Its annuity portfolio, which includes leasing operations, spans over 44 million square feet, underscoring DLF’s balanced approach to growth in both development and annuity-driven business segments.

As DLF remains on track to achieve its ambitious fiscal targets, its strategic expansions and consistent growth underscore the continued strength and resilience of India’s real estate sector. The company’s performance not only reflects effective market adaptation but also highlights the potential for long-term value in India’s booming real estate landscape.

English

English